What does it look like when you build a bank like a tech firm?

I believe Monzo, now sitting at 2 million customers, represents the future of banking. The bank hasn't necessarily innovated on the typical banking business model but it has redefined how a bank builds and launches its products and ultimately communicates with customers. With ambitions to grow to 1 billion customers and beyond, Tom and the team are doing things differently.

The topics discussed here represent my years of study of the bank but not necessarily the inside-out view; if I have described anything incorrectly, please do let me know.

Brand

Monzo's brand has been sharp and consistent since launch. Their tone of voice is generally regarded as honest, transparent and friendly with each blog post bylined by a single individual. Bringing this to life is their Tone of Voice guide, a straightforward document that all companies can learn from.

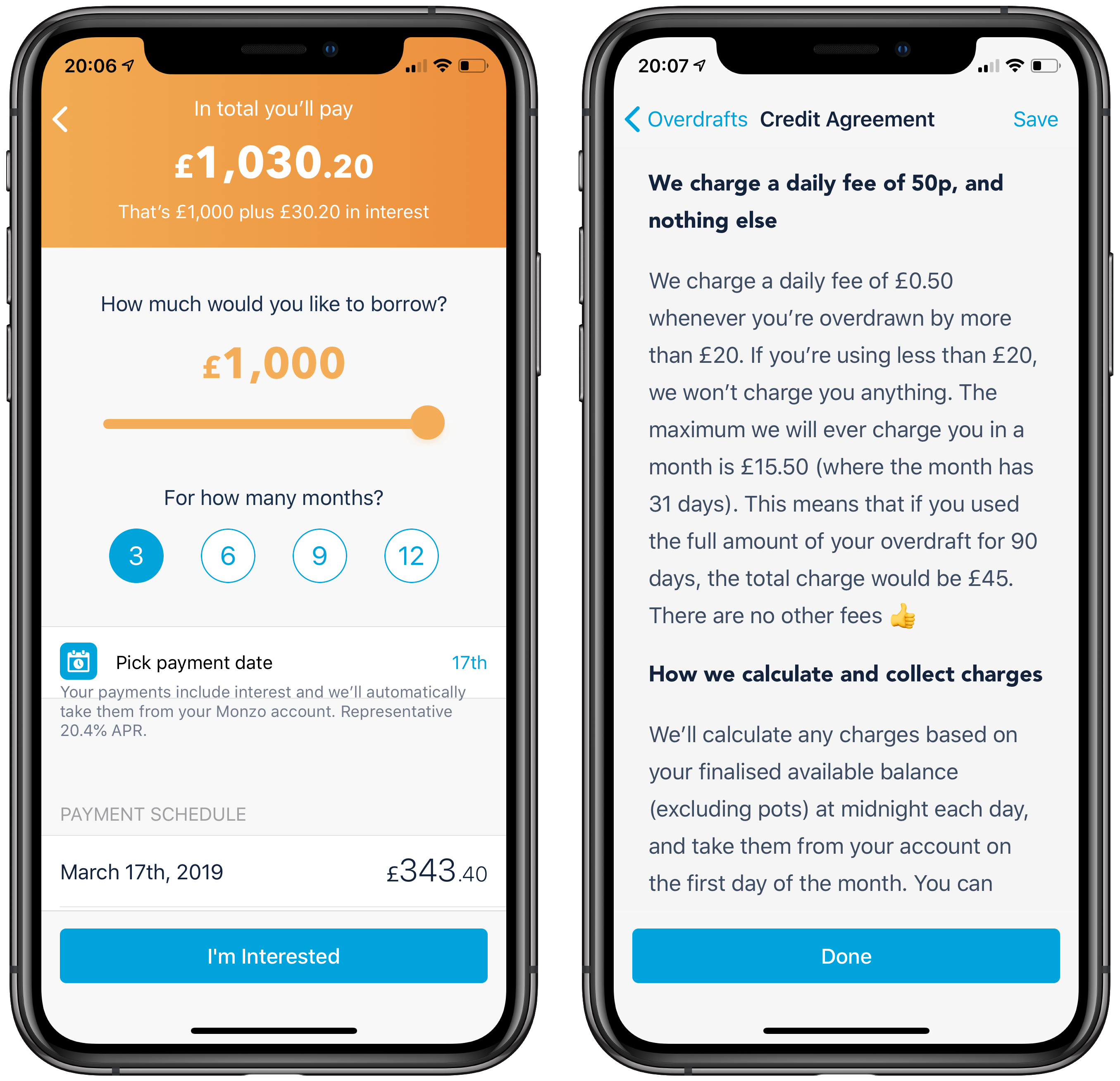

Likewise, their product experiences and policies treat customers fairly and are often educational rather than designed to confuse. Taking the overdraft experience as an example:

- Customers are presented with a concise, jargon-free set of terms and conditions

- Customers have complete control over the size of their overdraft

- Upcoming charges are highlighted through notifications and transaction feed entries

Of course, Monzo has had the ability to build a brand from scratch, avoiding the inheritance of the traditional banking perception and acting more like a social enterprise.

Experience

There is a particular focus of Monzo's that I feel is increasingly underestimated – they are competing on user experience.

Current accounts are a commodity with little room for core product innovation. Innovation must therefore occur in the experience or in cost reduction. With many free accounts available in the UK and tight margins, experience is the only remaining differentiator.

In fact, though, consumer expectations are not static: they are, as Bezos’ memorably states, “divinely discontent”. What is amazing today is table stakes tomorrow...

— Ben Thompson, Stratechery

The Mastercard 3D Secure flow shows this best. Monzo replaced passwords with app-based authentication and a clear interface. Customers are guided through a familiar, trusted flow that reduces confusion.

This is possible because Monzo involves every employee in research and design.

Side-note: Older users often prefer mobile apps over mobile web. Apps are trusted, always in the same place, and feel safer than navigating to unfamiliar URLs.

Focus

Monzo has stayed tightly focused on the personal current account, expanding cautiously. They’ve bet on aggregation, not proliferation. Fintechs that go deep (like Monzo) tend to fare better than those that go wide too quickly.

This PCA + Marketplace model:

- Reduces Monzo’s regulatory burden

- Increases competition and consumer choice

Compared to RBS, Monzo serves over 6x as many customers per employee. While product mix and legacy systems differ, it’s a powerful indication of efficiency and scale.

The model is maturing – Monzo has launched savings accounts with Investec, OakNorth, and Shawbrook, and others (e.g. Big 4 banks) have joined with Yolt and Cleo. Monzo’s community forums and Open Office events show steady progress through constant iteration.

Collaboration

Monzo’s rise has coincided with growing collaboration in FS. Their developer-first approach builds goodwill and sparks innovation.

Take the Flux integration: rather than hardcode an API for one partner, Monzo built a public receipts API from day one. They documented it, promoted it at hackathons, and supported external developers – multiplying the value of a single build.

Looking to the Future

Monzo’s mindset is the definition of digital. Their mission – 1 billion customers – sounds outlandish, until you remember WhatsApp, Instagram, YouTube, Android and iOS have all achieved that.

They’re betting on scale, trust, and experience. And the way things are going, they just might get there.